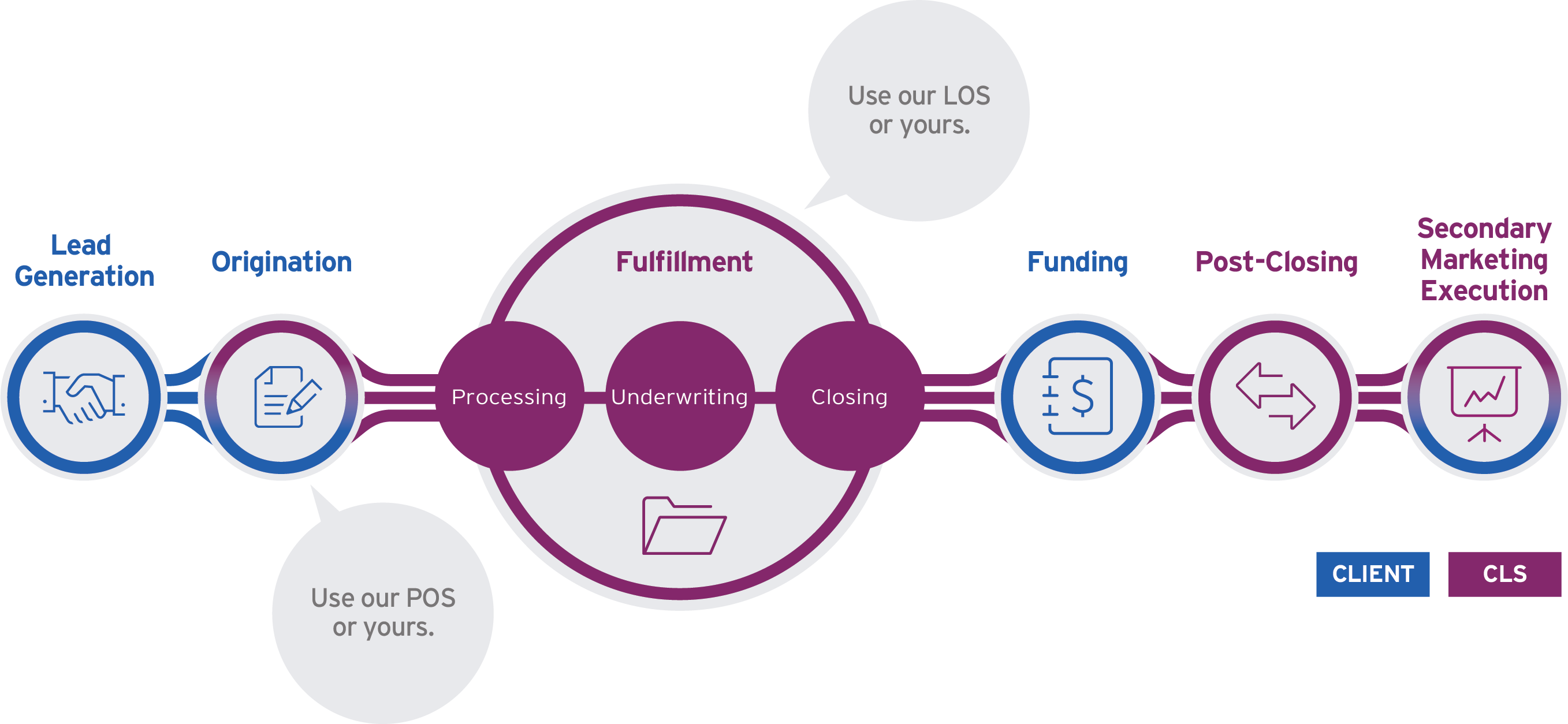

An overview of our fulfillment model

8 great reasons to select CLS’ fulfillment solution

Model versatility

Choices are important! With us, you can outsource your end-to-end process or just components. Plus, you have the option to use our POS and LOS technology or yours.

Pricing flexibility

We work with you to select the pricing model that best fits your originations strategy.

Private label solution that supports your brand

From application through closing, we are a part of your team. You can trust that your brand and your reputation are at the center of all that we do.

Full people management services

We reduce your staffing burdens by recruiting, hiring, and training the industry’s top talent. We complete pre-employment screening, security, and compliance training, plus ongoing license review and renewals.

Full-scale compliance support

Tap into a culture of control that helps you mitigate risk. Our team has three lines of airtight defenses, and we partner with you to develop, implement, and maintain your policies and procedures.

Best-in-class technology

Leverage our POS and LOS to reduce your technology maintenance costs. If you are happy with your current tech, we easily integrate into your systems.

Options to scale quickly

Rates up, business down, or rates down, business up? A switch to home equity products? Opening a new region? We are fully licensed in all 50 states and Puerto Rico, with a comprehensive set of mortgage loan types that we can fulfill.

Flexible continual support

Gain the power of staffing up or down according to your volume. Access a client support team that will be there for you every step of the way, from processes and pipeline reviews to inquiries about loan-level details.

We've spent 20 years perfecting mortgage fulfillment

Learn how we're bringing together the industry’s best talent to deliver fulfillment solutions that set us apart.